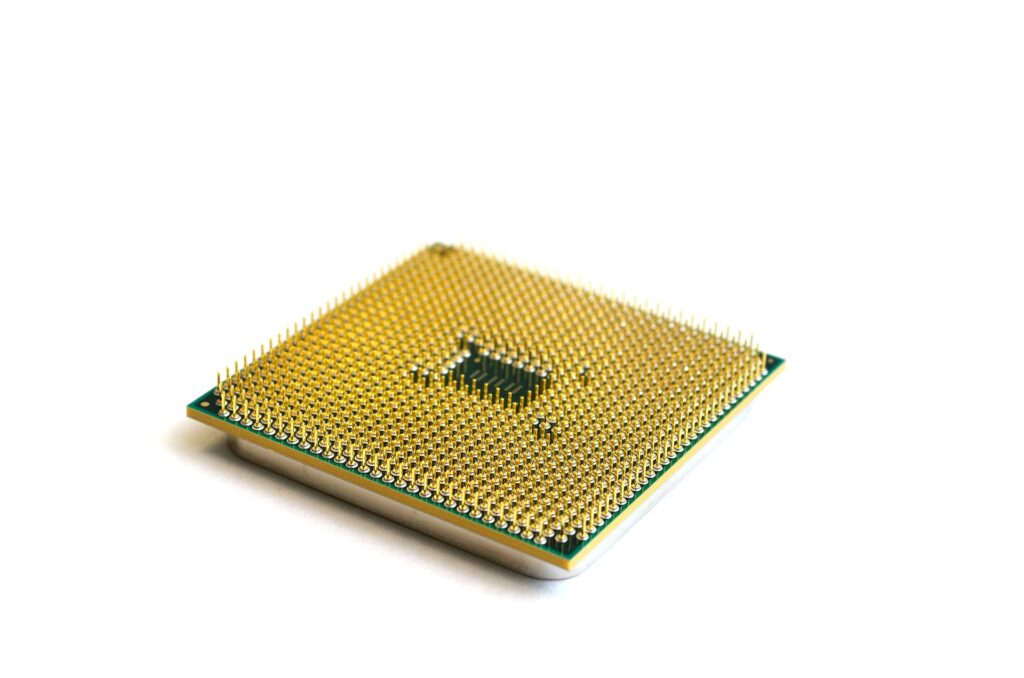

Vehicle logistics threatened by microchip shortage

8th September 2021

The Finished Vehicle Logistics (FVL) industry faces major new challenges. The current microchip crisis threatens the very existence of the logistics industry that moves new cars.

Inventories are close to zero, volumes have fallen dramatically, factories are closing without notice, unbalanced flows are destroying efficiency and thus profitability. The result is empty yards, empty workshops, idle and under-utilised car transporters, trains and ships.

The industry has never before been so unpredictable and planning has become impossible with supply chain visibility in vehicle manufacturing almost non-existent in the lower tiers. A consequence of this is an almost total absence of meaningful volume forecasts to logistics operators.

The Covid pandemic destroyed profitability in many industries and vehicle logistics is no exception. Unbelievably the global shortage of microchips is now causing an even more disastrous crisis. While governments worldwide supported industries through the pandemic this new crisis is hitting the sector even harder, and it not only lacks government support but company reserves have been eroded or destroyed over the last 18 months as the sector has lost an estimated €4.5 billion in turnover.

ECG – the Association of European Vehicle Logistics – is calling for the automotive industry to take all possible steps to support their logistics suppliers. Many potential measures are available to them including suspension of bonus-malus performance measures, postponing tenders until markets have regained some stability, sharing of production schedules in real time, reviewing lead times and shipping frequency and so on.

Wolfgang Göbel, ECG President, said: “Components are manufactured worldwide and delivered to the automotive industry via global supply chains involving highly complex planning. The problem is not the lack of planning competence of the companies, but the fact that other industries are competing for the semiconductor products and global demand exceeds supply for the foreseeable future.

“As a result the FVL industry is seeing huge variations in volumes at very short notice making capacity planning almost impossible. The problems are not so much in the logistics chains, but mainly in the production lead times and also a bit in the classic bullwhip effect.”

He went on to say: “Long-term contracts with our customers narrow the operational planning scope for us. We need more accurate information for planning certainty to ensure our efficiency and avoid significant additional costs that are not offset by customers. Our member companies are happy to deliver, but the industry must also let them.”

All of this comes at a time when the industry is coping with astonishing levels of change – a topic that will be addressed during the annual ECG Conference in Brussels on 14/15th October 2021. Not only are the products changing fast as electric vehicles replace the internal combustion engine drive trains, but the manufacturers are completely reinventing their sales and distribution models which will require different assets as online activities take business from the historic dealer networks.

In addition, as with all supply chains, there is immense pressure to decarbonize as fast as possible and to address the aspirations of the European Commission in the ‘Fit for 55’ proposals. All of this is going to require significant investment in people, assets, systems and so forth. In short, almost every aspect of the FVL industry will change. If the industry is not supported and protected from the impact of the short-term crisis such long-term investments will prove impossible.