75 million pounds energy overspend in warehouse sector

13th August 2015

According to new analysis conducted by the Energy Efficiency Financing (EEF) scheme, small and medium-sized enterprises (SMEs) in the warehouse sector are overspending by over ?75 million per annum on their energy bills as a result of inefficient technology and old equipment.

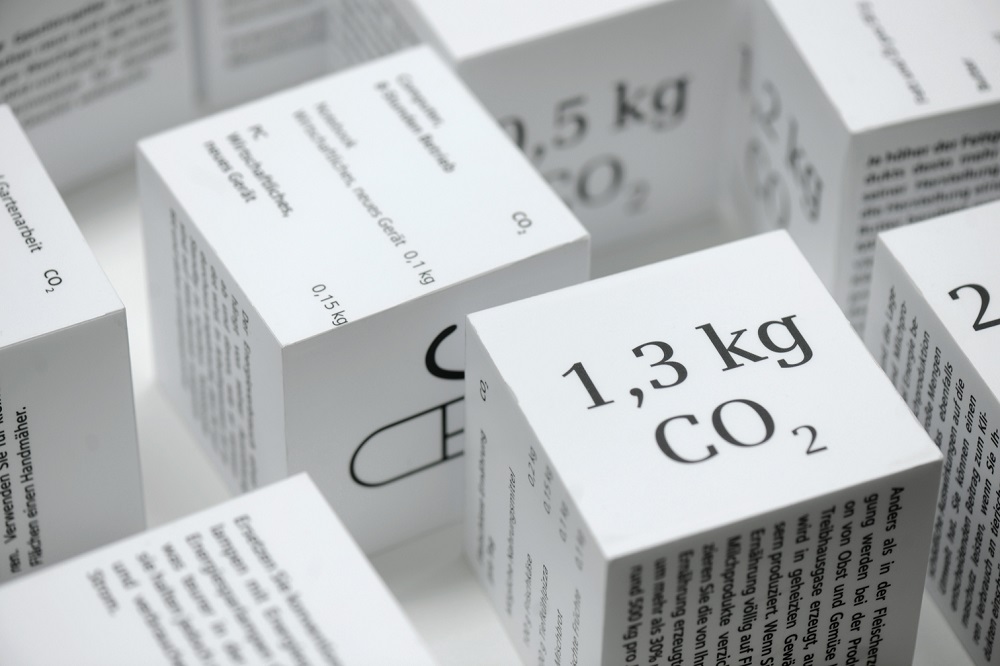

Based on proprietary data and official sources, the EEF scheme has analysed the energy expenditure of selected key industries to estimate their annual energy overspend. Having scrutinised each sectors use of lighting, heating and hot water, cooling and ventilation, and other areas of energy consumption, the EEF study reveals that potential energy savings of over ?414 million could be achieved per year by the UKs service sector SMEs (of which over ?75 million is represented by SMEs in the warehouse sector), were they to invest in more energy-efficient equipment.

The EEF scheme, a joint initiative between the Carbon Trust and Siemens Financial Services, aims to make finance for the acquisition of energy-efficient and renewable energy equipment more accessible and affordable for companies, in particular SMEs. Data from Bank of England shows the annual growth rate in the stock of SME lending to have shrunk since the second quarter of 2009.[1] Although there are some recent signs that this trend may be turning the corner, business lending will take a long time to recover, and may not reach pre-financial-crisis levels because of stringent recent regulatory rules.

Darren Riva, Head of Green Financing of the EEF scheme, commented: Todays tightened credit environment makes it increasingly difficult for SMEs to obtain affordable funding as traditional lenders have become more risk-adverse in their lending policy. Consequently, many firms feel discouraged from investing in green technologies because of insufficient access to capital. However, with funding available from innovative schemes like EEF, where expected savings pay for the investment, organisations can now act on their green endeavor without having to worry about upfront capital.

Myles McCarthy, Managing Director of Carbon Trust Implementation Services, added: By investing in energy-efficient equipment as well as renewable energy technology, businesses can reap significant energy savings and cut down on their energy bills. Any sort of green investment is a step towards saving money, improving business competitiveness, and being a responsible citizen. Organisations that recognise the long-term benefits brought by energy efficiency will no doubt be better positioned than their competitors to grow their businesses more sustainably and profitably.

Launched in 2011 as the first dedicated low carbon finance scheme in the UK, the EEF scheme unlocks business investment by providing finance for a wide range of green technologies, such as low energy lighting, solar PV, energy-efficient motors, low carbon air conditioning or biomass heating for UK businesses from any sector. The scheme aligns monthly energy savings/or income from energy generation with tailored monthly payments over an agreed financing period, making investment zero net cost, or even cash positive. Prior to finance being approved, the Carbon Trust conducts an independent energy savings assessment, giving businesses the additional assurance that the projected energy savings/income generation can truly be achieved.

Any business wishing to apply to the scheme for energy-efficient equipment finance should visit: http://www.energyefficiencyfinancing.co.uk.