Interroll reports strong order income and high sales growth in 2014

23rd March 2015

The Interroll Group managed to successfully continue on its growth course in financial year 2014. The company increased its sales by 6.0% to CHF 335.3 million (2013: CHF 316.3 million). On the one hand, this increase can be attributed to organic sales growth of 3.6%. On the other hand, adjusted for small divestments in Europe, the successfully integrated acquisitions of Portec, USA, and Pert Engineering, China, contributed 2.4% to sales growth. Incoming orders increased by 10.0% to CHF 350.7 million (2013: CHF 318.8 million) compared to the previous year. This only includes the first of a total of six sorters from the framework contract with the Brazilian Post that was announced in November 2014. The first sorter will be shipped in 2015.

Positive development in all product groups

The product group Drives (motors and drives for conveyor systems) continued on its successful course by posting sales of CHF 114.9 million (+5.0%).

The product group Rollers (conveyor rollers) recorded an increase of 7.7% to CHF 81.2 million. Here, the demand in all three regions was quite encouraging.

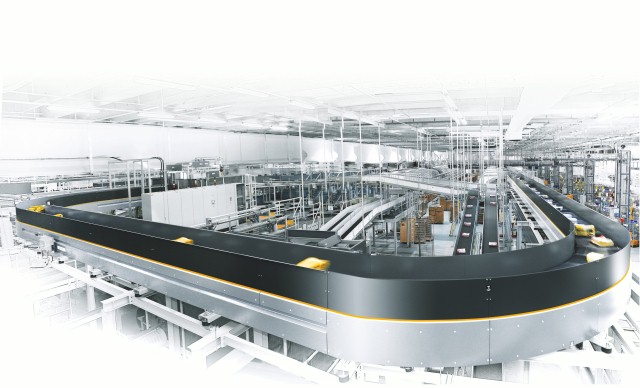

The 12.1% increase in sales to CHF 79.8 million in the product group Conveyors & Sorters can be attributed to the sustained trend toward automation, driven for the most part by e-commerce and ergonomics in working environments.

At CHF 59.4 million, the product group Pallet & Carton Flow (flow storage) was slightly below last years level because the one-time order from Red Bull Thailand valued at approx. CHF 6.5 million was already included in 2013.

Strong organic growth in the Americas, positive development in Europe

The three regions EMEA (Europe, Middle East and Africa), the Americas and Asia-Pacific developed differently in financial year 2014.

The growth in sales by 20.3% to CHF 81.9 million in the Americas region was characterised by strong organic growth of nearly 10% as well as the acquisition of Portec in July 2013. In March 2014, Interroll opened a new regional Center of Excellence in Atlanta and closed two production companies in North America during 2014. Production was concentrated at the Centers of Excellence in Wilmington and Atlanta and at the local assembly facility in Newmarket, Canada. The Portec site in Canon City is being expanded into a regional Center of Excellence.

The company is also seeing a positive development in Brazil. In November 2014, a framework contract was signed with the Brazilian Post together with a US system integrator that includes delivery of a total of six sorters between 2015 and 2017.

The EMEA region also recorded encouraging growth of 3.5% to CHF 210.2 million. Nevertheless, the individual European regions developed quite differently. In Central and South Europe, the business developed positively for the most part, whereas a temporary saturation in the area of internal logistics could be observed in Scandinavia in particular.

By recording sales of CHF 43.2 million, the Asia-Pacific region remained slightly behind last year’s level (CHF 45.2 million) due to the fact that 2013 included the one-time order from Red Bull Thailand valued at around CHF 6.5 million. Interroll continued to pursue its growth strategy in this region in 2014 by opening its new Asian headquarters in Shanghai and by acquiring Pert Engineering in Shenzhen, China. The company expanded its customer base even further in China and received repeat orders from important customers such as the Chinese Post. This lead to an increase in sales of around 26%.

Results impacted by one-time strategic investments

Interroll made high strategic investments in long-term growth and sustainable profitability in 2014. Development costs, the introduction of the modular conveyor platform, but also the consolidation of plants in the USA as part of the Portec acquisition in 2013 and the new Center of Excellence in Atlanta had a one-time negative impact on the results of financial year 2014.

Nevertheless, earnings before interest, taxes, depreciation and amortisation (EBITDA) only decreased slightly to CHF 44.1 million compared to the previous year’s figure of CHF 45.4 million (-2.8%). The EBITDA margin was 13.2% (2013: 14.3%). Amortisation for acquired customer values, patents and licenses increased to CHF 3.9 million in 2014 (2013: CHF 3.2 million). Portecs assets were amortised for the complete financial year for the first time.

Earnings before interest and taxes (EBIT) decreased to CHF 25.4 million (2013: CHF 27.2 million). The EBIT margin declined from 8.6% in the previous year to 7.6%. Net profit decreased slightly to CHF 19.1 million by annual comparison (2013: CHF 20.5 million).

Outlook for 2015: Plenty of opportunities

Interroll continues to see positive development opportunities in dynamic markets such as airport logistics, postal and logistics providers, food processing, distribution and industries, whose internal logistics hold significant optimisation potential. The consistent focus on innovation, growth and productivity define Interroll’s strategy. In this spirit, forward-looking projects such as the development of the modular conveyor platform and the strengthening of the sales force in China and the USA were completed in 2014. The decision that the Swiss National Bank made on 15 January 2015 to stop supporting the euro’s minimum rate will considerably lower the Interroll Groups growth expressed in the reporting currency CHF, however. Profit will be impacted by translation currency effects in particular. All in all, opportunities will be predominant, an estimation that Interroll certainly shows by proposing a higher distribution to its shareholders.