Road freight prices break records as fuel costs soar

7th July 2022

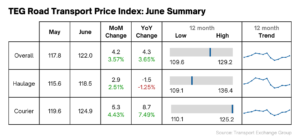

The latest TEG price index data reveals road transport businesses passing soaring operating costs onto customers – as June’s average price-per-mile for haulage and courier vehicles reaches 18% more than three years ago, and its highest level so far in 2022.

The average price-per-mile for haulage and courier vehicles has jumped from 103.1 points in June 2019 to 122.0 points in June 2022, according to the TEG Price Index – a rise of 18% over the three-year period.

The average price-per-mile for haulage and courier vehicles has jumped from 103.1 points in June 2019 to 122.0 points in June 2022, according to the TEG Price Index – a rise of 18% over the three-year period.

In the last year alone, the TEG index shows a year-on-year price-per-mile increase of 4.3 points.

This surge in what hauliers and couriers are charging comes against a backdrop of record-high fuel prices in the UK: 167p for petrol and 180p for diesel.

With fuel prices and inflation continuing to soar, road freight businesses are facing an ever-tightening squeeze on their profit margins, leaving them with little choice but to increase the price of their services.

The year-on-year index figure has climbed consistently every month since the start of 2021. This reflects the cost pressures building in the road freight industry over the last 18 months, including the driver shortage, rising salaries and a hike in companies’ national insurance payments. In the face of these issues, the sector will have to show more of its customary resilience.

Freight profit squeeze means higher consumer prices

According to the Road Haulage Association, fuel represents over a third of a truck’s operating costs, and profit margins are between 1% and 2%. So every penny counts, with increases in fuel prices having a massive impact on businesses’ bottom lines.

The industry has called for an essential user rebate, which would cut fuel costs for hauliers and, ultimately, help reduce costs for the end consumer.

The need for relief from runaway inflation is becoming increasingly urgent. For 60% of the UK public, total bills are higher than income, according to researchers at the National Institute of Economic and Social Research.

Lyall Cresswell, CEO at Transport Exchange Group and new platform Integra, says: “From operational costs to ongoing driver shortages, we hear about industry issues every day from our members. However, they’re coping admirably with the pressures and the constantly shifting landscape.

“With consumer confidence at a record low, we may well see a slowdown in demand for road freight, as fewer people shop online. But this might actually give the industry a little breathing room, softening the impact of driver shortages and supply chain bottlenecks.

“Nobody really knows what the future has in store, but we’re obviously very keen to see an essential user rebate. There’s no question that hauliers and couriers are essential users and such a move would provide some respite for the industry – and consumers.”

Kirsten Tisdale, Director of Logistics Consultants Aricia Limited and Fellow of the Chartered Institute of Logistics & Transport, says: “The TEG Road Transport Price Index continues to give insight into the UK freight market. The ever-tightening squeeze on the profits of the road transport sector and the impact on customers can also be seen in the latest Business Insights survey by the Office for National Statistics, where 1 in 8 of the responses for Transport & Storage companies indicated that they were having to seek financial support (up from zero in the previous survey where this question was asked), aggravated by the trend for increased stockpiling.”