Logistics operations are increasingly turning to integrated technology solutions to overcome a host of transport planning pressures, while at the same time the driver and general skills shortage continues to weigh on the supply chain sector. These were two of the key findings from Paragon Software Systems’ annual UK customer survey, which was completed by more than 100 industry professionals. It found that almost all respondents (97%) are using some type of telematics solution and almost half (45%) are interfacing this technology with their routing and scheduling software.

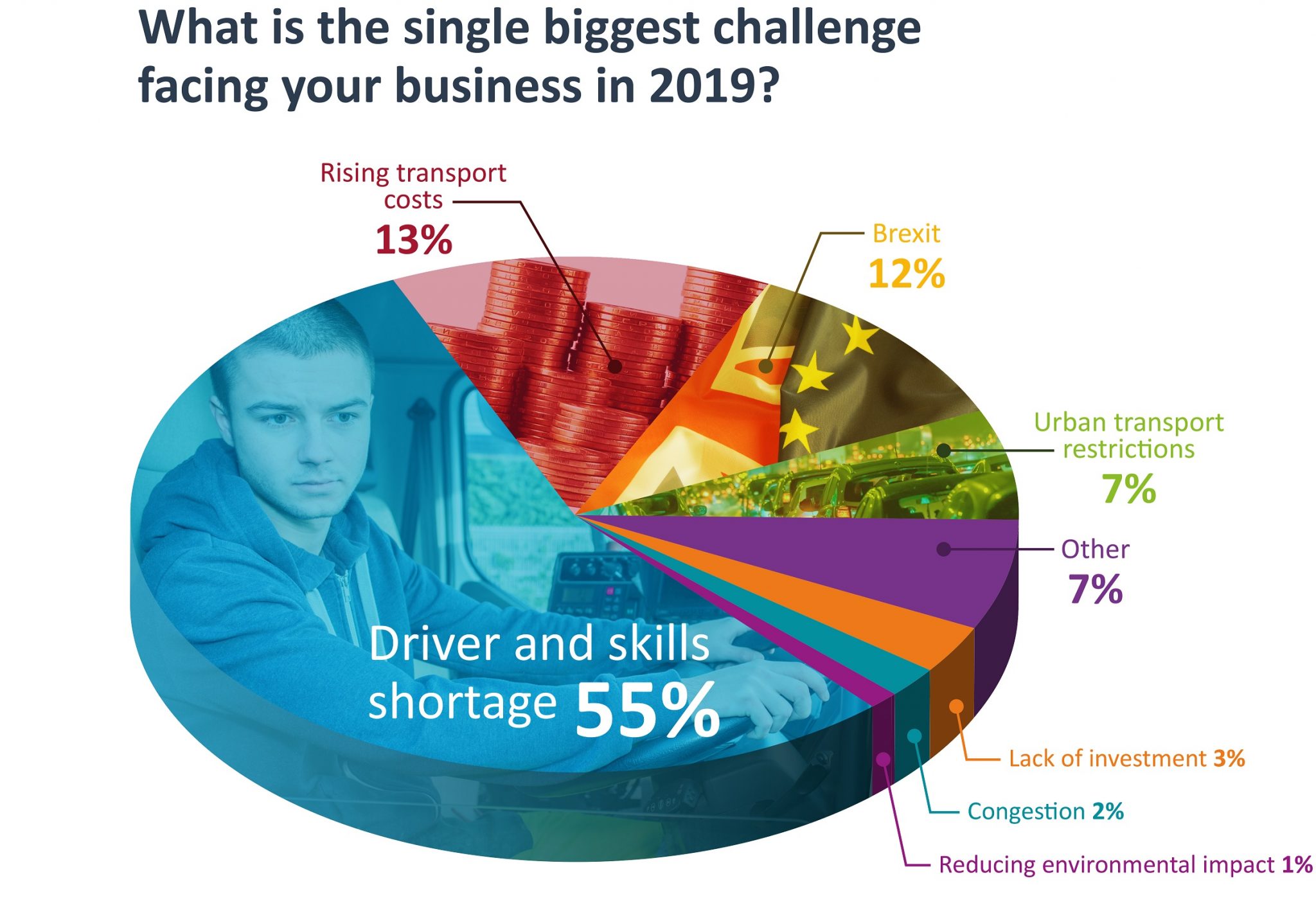

Meanwhile, the lack of drivers and other skilled workers remains the biggest challenge facing the industry for the third year running according to over half of the survey’s respondents (55%). This represents a 20% increase when compared to last year’s results (46%) and a significant 62% rise from 2017 (34%), suggesting a growing concern amongst businesses within the marketplace. Other notable issues highlighted were rising transport costs (13%), Brexit (12%), and urban transport restrictions (7%).

The 2019 survey results showed that technology is now playing a critical role within road transport to gain added visibility and control. Most fleets are now using vehicle tracking (95%) with over half (52%) also utilising electronic proof of delivery. Other popular solutions include 3G/4G vehicle cameras (40%), live temperature monitoring (25%) and workforce management apps (20%). Transport operations integrating these systems with their routing and scheduling software are doing so to take advantage of real-world data that supports real-time performance monitoring and continuous improvement.

Demand for more accurate time windows (44%) was again pinpointed as the biggest transport planning pressure followed by the ability to compare planned routes with what is actually happening on the road (39%) and the need to maximise the utilisation of available drivers (34%). Meanwhile, almost three-quarters of the respondents said they have had to adapt their service in the past year to meet changing customer demand. In particular, the provision of tighter time windows (31%); ETA on the day of delivery (28%); more frequent communications (22%); and proof of delivery (20%) were the most cited changes.

With transport planning becoming increasingly complicated, almost half of respondents (49%) stated that their planning resource had changed in the past 12 months, with 22% becoming more centralised and 16% growing their team. A large proportion (78%) felt they would significantly or slightly benefit from having greater automation in the transport office, while a number (9%) had already taken steps to fully automate their operation.

William Salter, Managing Director of Paragon Software Systems commented: “The results of our survey suggest the road transport sector faces another tough year with a number of continuing challenges that are compounded by the current economic and political uncertainty. As a result, logistics operations are looking to integrated technology solutions that deliver real benefits in terms of better resource utilisation, improved customer communications and real-time visibility of fleet performance.”