Global logistics provider and emerging markets specialist Agility today reported 2019 net profit of KD 86.8 million, or 52.14 fils per share, an increase of 7% from 2018. Revenue for the year reached KD 1,578.6 million and EBITDA was KD 193.1 million, increases of 1.8% and 24.7%, respectively.

For the fourth quarter 2019, Agility reported a net profit of KD 23.2 million, or 13.93 fils per share, an increase of 4.4% over Q4 2018. EBITDA for Q4 2019 was KD 50.7 million, an increase of 24.3%, revenue remained flat.

Agility continues to deliver growth despite regional and economic challenges, it said.

“Global trade tensions, regional economic uncertainty, and financial market pressure in emerging markets all contributed to a challenging year for our logistics business. Internally, the costs associated with our investment in digitization also had an impact; one that we believe will continue in 2020,” said Tarek Sultan, Agility Vice Chairman and CEO. “Driving operational efficiency and better customer service through digitization continue to be a priority. It is an investment in our future.”

Beyond digital, emerging markets also remain a key investment focus, said the company. This includes building logistics parks across the Middle East and Africa, the Reem mega-mall project in Abu Dhabi, bringing on new ocean vessels and fuel farms through its fuel logistics subsidiary, and growing rapidly in Africa through its airport services subsidiary.

In its warehousing logistics arm GIL (Global Integrated Logistics) for the full year 2019, GIL EBITDA was KD 35.4 million, a 1.4% decline from 2018. This decline was mainly driven by the costs associated to the acceleration of the digital transformation, the company said.

Year-to-date net revenue improved 2.9%. Net revenue growth was driven by strong Freight Forwarding yields; higher warehouse utilization and new facilities in Contract Logistics; and greater contributions from specialty products (Project Logistics and Fairs & Events). GIL consistently executed well on its commercial strategy, showing growth with selected industry verticals that are strategic priorities such as Life Sciences, it said.

Full year 2019 revenue fell 2.5% and remained flat on a constant currency basis. 2019 was a challenging year for the freight forwarding industry as a whole. According to IATA, 2019 witnessed the lowest air freight volumes since 2009. Full Year Air and Ocean Freight volumes decreased by 6.8% and 0.6% vs. 2018 driven by declining market demand, but were offset by higher yields.

GIL fourth quarter EBITDA was KD 10.9 million, a 3.8% decline from same period in 2018. The decrease was due to higher operating expenses related to new Contract Logistics facilities, as well as investments in digital transformation.

GIL’s Q4 net revenue was KD 70 million, a 3.3% increase vs. Q4 2018. The net revenue increase was driven mainly by growth in Project Logistics, Contract Logistics and Fairs & Events. The overall net revenue margin improved to 24.8% in Q4 2019 vs. 23.1% in Q4 2018. GIL gross revenue was KD 282.7 million, a 3.7% decline (or 2.6% decline on a constant currency basis) from same period in 2018.

Q4 Air Freight volume decreased by 7% (in tonnage) as a result of falling trade volumes and lower demand from customers across industries and geographies. This decline in volume was partially offset by higher yields – expressed as net revenue/ton – which increased 1.1% from same quarter last year.

Ocean Freight TEUs grew 1.9%, but Q4 yields declined 2.2% vs. the same period in 2018. GIL Ocean Freight yields were strongest in the Americas and Europe.

Contract Logistics achieved healthy growth, mainly in the MEA Region (Kuwait, Saudi Arabia) but also in the US, Australasia and Singapore. Project Logistics also showed solid growth in multiple countries.

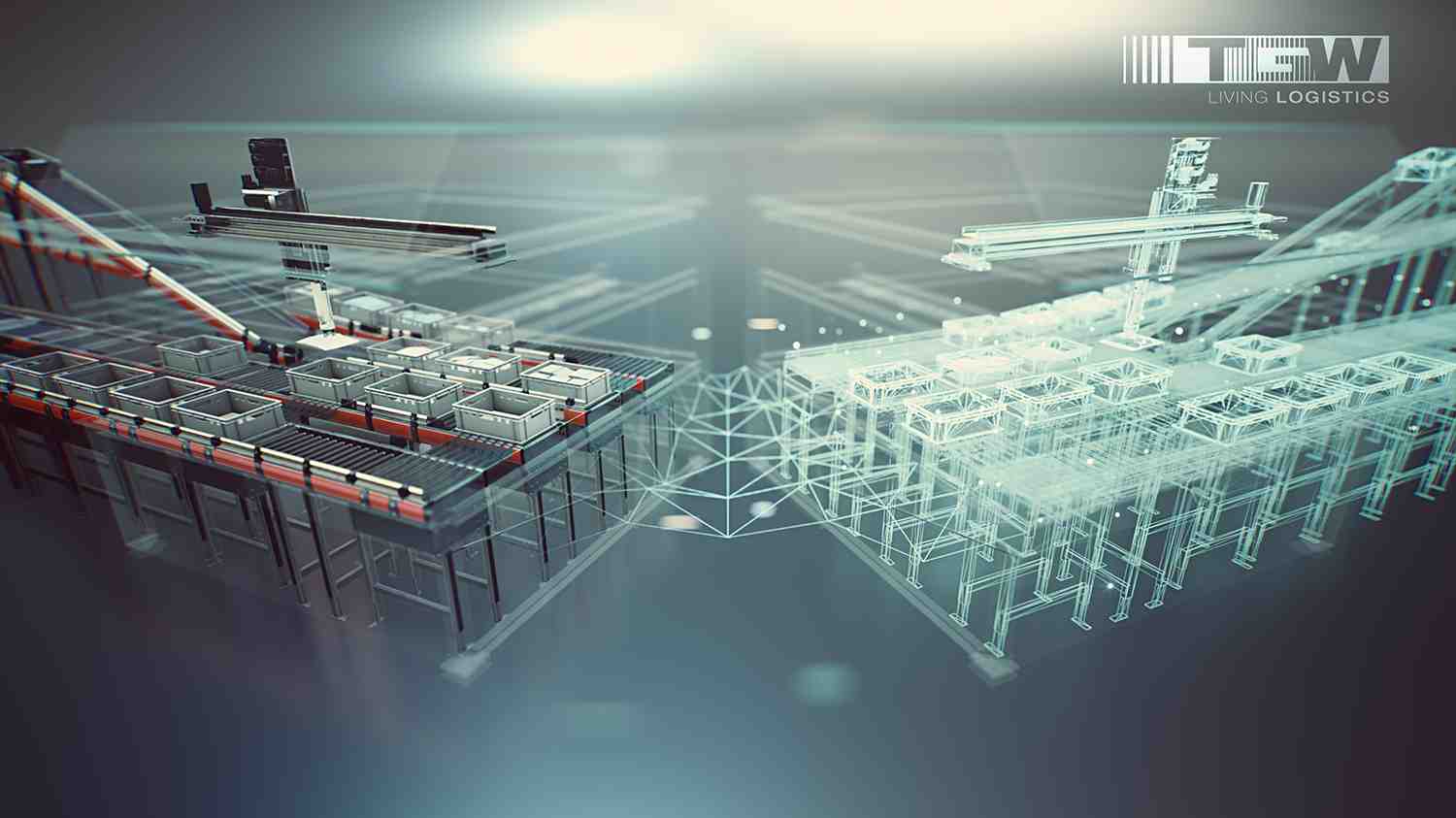

To strengthen performance and its market differentiation, GIL is implementing its digital strategy. By accelerating its digital transformation, GIL intends to enhance customer and supplier connectivity, create innovative customer solutions, increase the efficiency of its business processes, and enable comprehensive business insight.

Agility’s Infrastructure Companies

Agility Logistics Parks (ALP) reported 14.9% revenue growth for the year, despite challenging market conditions. In Kuwait, ALP’s focus is driving the efficiency and optimizing the use of existing assets. In Riyadh, Saudi Arabia, ALP completed another 120K sqm of warehousing space in 2019. In Africa, developments in ALP Ghana Phase III and Phase I in both Mozambique and Ivory Coast are approaching completion.

Tristar, a fully integrated liquid logistics company, posted 10.9% revenue growth in 2019, mainly from Fuel and Maritime improvements. Fuel sales increased mainly in Africa and Yemen. Additionally, improvements were realized in the Road Transport and Warehousing (RTW) segment coming from new contracts. Tristar is focusing on a growth strategy across all business segments. New vessels in the Maritime segment are expected in second half of 2020. RTW will continue to ramp-up existing contracts with mining companies and oil majors. In addition, Tristar is investing in new fuel farms in Africa.