Port Boulogne Calais has once again demonstrated its resilience both in terms of fishing and cross-Channel traffic. Both ports showed solid results for 2023.

After a very good year in 2022, the port of Boulogne-sur-Mer confirmed its dynamism in 2023. With €89.1 million in value (+ 2%), it once again, for the second consecutive year, reached its highest level for 20 years. Fish volumes are up 8% compared to 2022, and have crossed the symbolic 30 000 tonnes (30 437 t) threshold, returning to their level before the introduction of Brexit.

Reduced catches of certain species such as sole, mackerel and whiting are offset by ever-increasing volumes of cephalopods (squid and cuttlefish), red mullet and scallops, stocks of which are in excellent condition. The port of Boulogne-sur-Mer remains the leader in the ranking of French fishing ports in terms of tonnage and value.

Despite legitimate fears in the fishing industry over the implementation of Brexit, given the proximity of the port of Boulogne to the British coast, the Individual Support Plan (ISP) will ultimately have had only limited impact on fishing capacity in Boulogne. Although regrettable, a total of six units specialising in small-scale fishing and a single trawler will have benefited from this decommissioning plan, representing less than 5% of landings.

2023 was the first full year in terms of tourist traffic since the health crisis and complete lifting of travel restrictions in March 2022. The partial resumption which began in 2022 was confirmed in 2023; the port of Calais welcomed 7 263 513 passengers and nearly 1.3 million tourist vehicles, representing an increase of +41% and +33% respectively compared to 2022. This double-digit increase was driven by an excellent summer season which almost achieved a return to pre-health crisis figures of just over 2 million travellers and nearly 450 000 vehicles in July and August alone.

In terms of freight, the port of Calais is proving more important than ever. While the Channel saw a slight contraction of the freight market of 2% in 2023, the port of Calais performed well,

with an increase of +10% in its traffic. With 1 809 813 freight units (heavy goods vehicles and unaccompanied trailers), it returned to its pre-Brexit level and exceeded the 50% market share milestone. Hold capacity, flexibility, optimised fluidity with the new terminal and dematerialised border crossing for goods have strengthened the port of Calais’ position as a preferred crossing point for transport professionals.

After several years of strong growth, unaccompanied freight slowed down in 2023. Down 12% to 55 010 units, this traffic struggled in particular in the last quarter, mainly due to temporary availability on the market of drivers of heavy goods vehicles from Eastern Europe, which encouraged carriers to turn to accompanied mode. Furthermore, the Ro-Ro service operated by DFDS to Sheerness then rerouted, in summer, to Tilbury didn’t meet its promises; this new destination required carriers to adapt to reorganise their logistics. DFDS finally cancelled this service at the end of the year.

While combined transport at the national level is experiencing a sharp drop in activity of 20%, the rail motorway services that serve the port of Calais are holding up well and even progressing very slightly by 1% (41 641 units). A genuine achievement for the operator VIIA in a very unfavourable national situation.

Overall, activity at the Calais and Boulogne-sur-Mer general cargo terminals remained stable in 2023, with total tonnage of 1 899 633 tonnes in 2023 compared to 1 917 435 in 2022. The Boulogne terminal handled 642 501 tonnes (-2%), which breaks down into 486 042 tonnes for export and 156 460 tonnes for import. The main materials handled for export remain limestone and quicklime, mainly destined for Sweden. On import, bulk mainly covers raw materials (natural sand at 102 000 t and road salt at 24 000 t). The emergence of pellet traffic (21 000 tonnes) should also be noted.

At the Calais terminal, bulk activity also remains stable at 590 876 tonnes (-2%). Almost all bulk tonnage is intended for export and consists of limestone and pebbles for the Nordic countries (Sweden and Denmark) and sand and aggregates for the United Kingdom. For 2023, rail tonnage stands at 666 256 tonnes.

2023 was synonymous for the port of Calais with the return, in the summer, of new vehicle traffic, which had been at a standstill since 2015. The Charles André Group, the French specialist in automotive logistics, chose Calais for its know-how and the quality of its Ro-Ro and rail facilities, as well as for its special geographical position both close to the United Kingdom and the automobile production units in Hauts-de-France. For these first six months of activity, 10 400 new vehicles passed through the port. For 2024, expected traffic is more than 30 000 units.

After the dry dock at the port of Calais had seen no activity for several decades, it welcomed two ships in just a few months. SOCARENAM, a French shipbuilding flagship company based in Boulogne-sur-Mer, has been commissioned to construct six overseas patrol boats by the French Navy. The second ship to leave the shipyard was dry docked in Calais for finishing work.

Furthermore, running in parallel with a sustained workload schedule in the Boulogne-sur-Mer workshops, the company is in the process of building the first example of patrol boats intended for the Maritime Gendarmerie in Calais.

While the International Maritime Organisation (IMO) announced, last July, the objective of “zero emissions” from ships by 2050, the stakeholders of Cross-Channel – maritime and ports operators – have brought forward this plan and are already working to decarbonise maritime traffic across the Channel. On the sidelines of COP 26 in Glasgow, certain countries including France and the United Kingdom have committed, in the Clydebank declaration, to setting up “green maritime corridors”.

As early as last March, Port Boulogne Calais signed a cooperation protocol with ferry operator DFDS and the ports of Dunkirk and Dover aimed at agreeing on a joint work programme to enable the transition to electric maritime traffic across the Channel. The shared ambition is to provide a green maritime corridor (zero emissions) by 2030, which will necessarily involve the design of new-generation ships using propulsion technologies that are more environmentally friendly and, in particular, electric. The port of Calais is working with DFDS and its partners to prepare the infrastructure necessary for these future ships. At the end of 2023, DFDS confirmed its wish to order electric ships for the Calais – Dover line.

Anticipating the energy transition of all fleets, P&O Ferries put into service the very first hybrid ship operating on the Calais-Dover line last June. Specifically designed and created to operate on the Channel, the P&O Pioneer is the first ship to be equipped with a hybrid engine – diesel electric – allowing it to call into the ports of Calais and Dover without having to use its diesel engines or manoeuvre in the docking area thanks to its double-head design. All these innovations have led to a 40% reduction in CO2 emissions. The ultimate objective is to make the Calais-Dover crossing entirely electric. The P&O Pioneer will be followed by its sister ship, the P&O Liberté, which left China on 15 January and is due to arrive on the Channel in spring 2024.

For François Lavallée, Chairman of the Board of Directors: “2023 was a year of growth for Port Boulogne Calais. Calais regained its pre-crisis freight volumes and Boulogne fishing is continuing its good figures for 2022. We are already looking to the future, with major challenges ahead: the arrival of the EES arrangement (Entry & Exit System) at the port of Calais, accelerated greening of our two ports and the start of the upcoming renegotiation of fishing quotas between the EU and United Kingdom.”

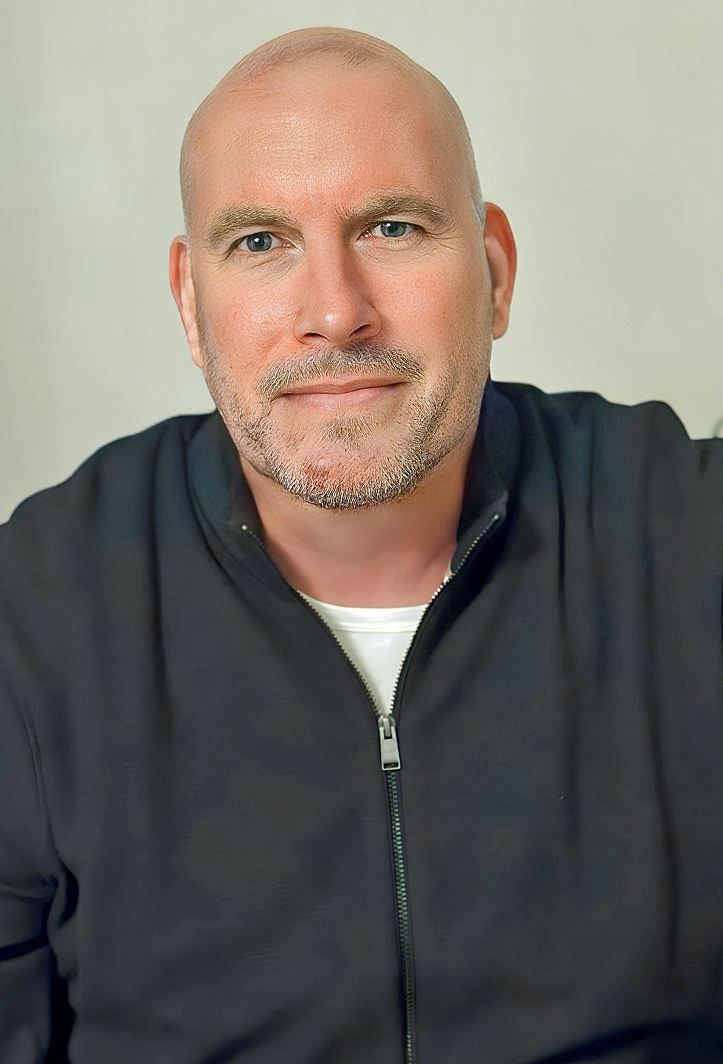

Benoît Rochet, General Manager of Port Boulogne Calais, adds : “I am delighted at the resilience shown by the ports of Boulogne-sur-Mer and Calais. The good results for 2023 for both cross-Channel traffic and fishing mean we can embark on this new year with confidence. The significant investments planned and already made by our customers in new ships specifically designed to serve the Calais-Dover line demonstrate their complete confidence in our port. The return of new vehicle traffic and recommissioning of the Calais dry dock show the extent of our know-how. The port of Boulogne-sur-Mer, for its part, is doing well, and the Capécure area remains very attractive for investors.”