INFORM, a leading software developer specializing in artificial intelligence and operations research, is thrilled to announce its latest study on IT in vehicle logistics, highlighting key findings on IT and AI’s transformative impact in the vehicle logistics sector. With a detailed analysis of current challenges, including capacity constraints and the need for greater operational efficiency and transparency, this report is grounded in insights from 106 industry professionals. The comprehensive study underscores a robust forecast for market growth and identifies key technologies driving innovation, also reflecting on the need for enhancements.

The publication of the “INFORM Trend Report on IT in Vehicle Logistics 2024 – Transforming Vehicle Logistics: Pivotal Role of IT and AI” marks the third installment in a comprehensive series of trend reports that delves into the evolving dynamics of vehicle logistics management. The 2024 Trend Report, built on the insights from previous surveys in 2018 and 2013, presents an in-depth analysis of the challenges and advancements within the vehicle logistics sector.

Key Findings from the Report

1. Market growth and increasing demands: One-third of participants each believe that the volume of vehicles handled will increase by 10-20% (33%) or even by more than 20% (34%) over the next five years. At the same time, more than half of those surveyed (56%) fear they will have to contend with capacity issues until 2025 or much longer.

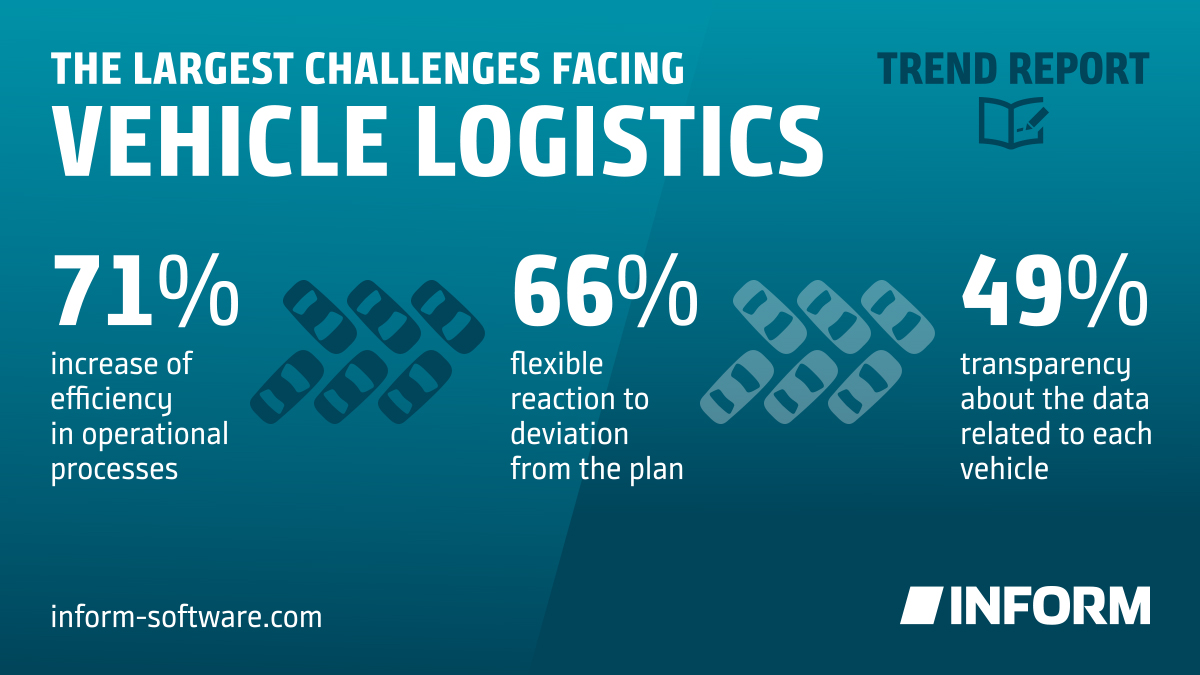

2. Challenges in the industry: Increase of efficiency in operational processes (71%), flexible reaction to deviations from the plan (66%), and transparency about the data related to each vehicle (49%) are the three current challenges most often rated as “very important” for the vehicle management process. For the first time, understanding and reporting CO2 emissions is also seen as essential, rated “very important” by one-third of respondents.

3. IT in vehicle logistics: The majority of companies (83%) rely on specialized software applications for vehicle logistics. Most companies deployed them in the last decade (58%). As for technologies that will affect businesses the most over the next five years, participants selected electric vehicles and trucks (72% and 47%, respectively), artificial intelligence (55%), and vehicle-based GPS telematics (44%).

4. Benefits of IT systems: The three predominant perceptions in the companies surveyed are that IT is a necessary business tool (61%) that helps in optimizing (58%) and automating (55%) processes. Looking at the next five years, respondents consider better data analysis (95%), increased operational efficiency (94%), and support for strategic and tactical decisions (94%) to be particularly important.

5. Less than state-of-the-art technology: A full third of respondents (33%) do not consider their own IT to be future-proof. Just 11% are completely satisfied with their vehicle logistics software. The most frequent complaints concern a lack of reporting, data mining, and analytics options (41%), web portals for communicating with partners (40%), and poor usability (38%).

“As we navigate through the rapidly evolving landscape of vehicle logistics, the role of technology has never been more pivotal,” said Hartmut Haubrich, Director Vehicle Logistics Systems at INFORM. “We recognize the transformative impact of AI on our industry, and it is with great enthusiasm that we present our latest survey report reflecting on the current market trends. It emphasizes the critical need for operational efficiency improvements and the transformative potential of AI in vehicle logistics. Our results also highlight the industry’s needed shift towards more collaborative and partnership-driven approaches to address capacity challenges and foster innovation.”

INFORM remains committed to driving innovation in vehicle logistics through its cutting-edge software solutions, helping businesses increase profitability and resilience in a rapidly evolving landscape.

Read More…

INFORM Delivers Time Slot and Yard Management to Swiss Retail Giant