Laboratory tests, field tests, certifications, formal approvals from transport authorities and ministries, products available to pre-order, order or deliver – the European toll market has not seen so much activity for years. But when it comes to Europe-wide toll boxes (EETS boxes), there is a great need for clarification if the product is to work as the customer is led to believe it should. Jürgen Steinmeyer (Director Toll at DKV Euro Service) explains what hauliers should bear in mind.

If an EETS box works in a country, can I install it in my vehicle, drive off and expect that the toll will be correctly settled and correctly shown on my invoice?

Yes and no. If a provider states that his EETS box works in this or that country, this can also mean that his product is technically capable of covering that country and its toll system or it has been successful in a previous field test.

As a haulier, how can I ensure that the box I ordered will work as it should on every occasion in the future?

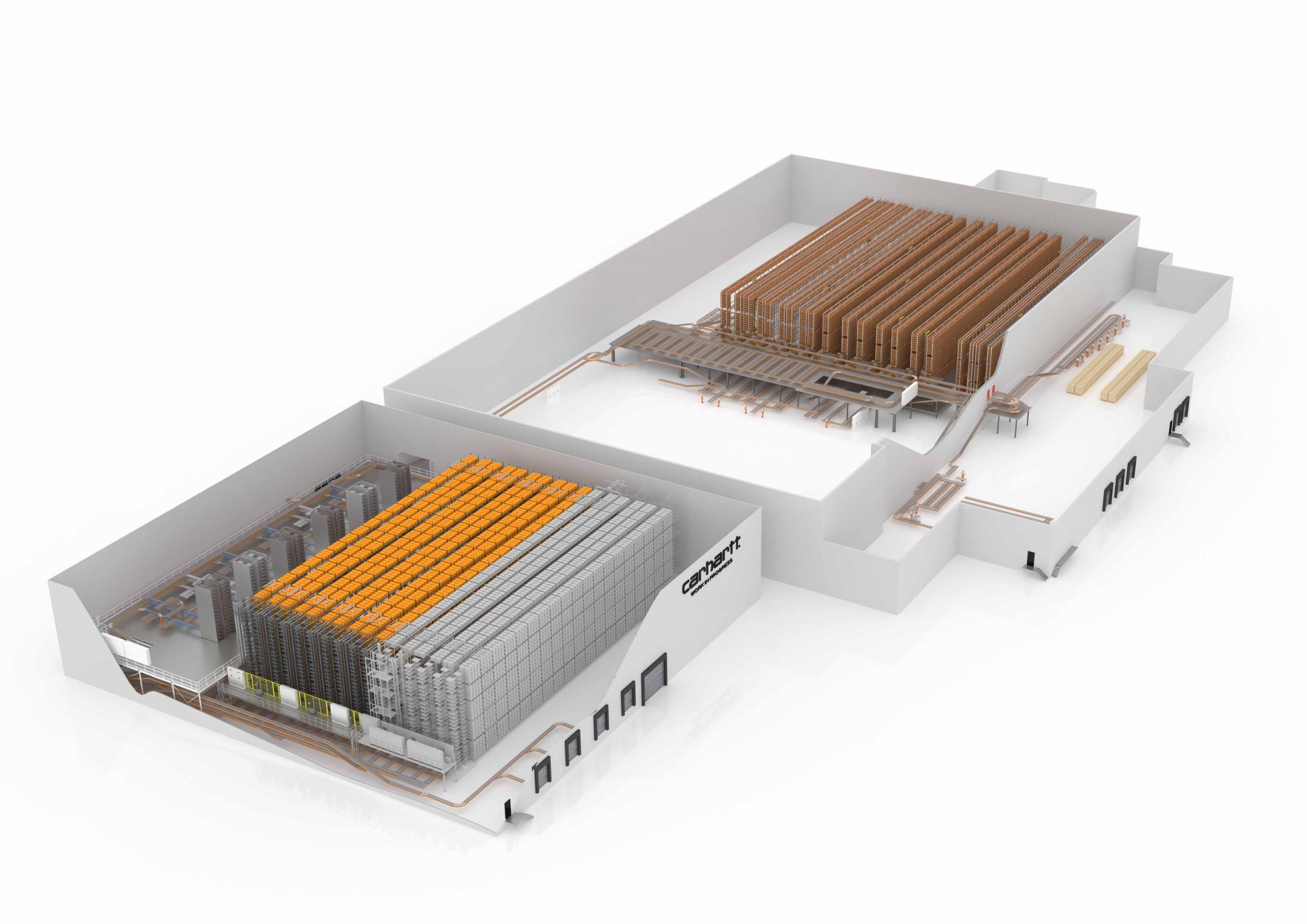

First of all, the toll service provider should be certified as an EETS provider or the box sourced from an EETS provider. DKV EURO SERVICE sources the DKV BOX EUROPE from Toll4Europe GmbH, a certified EETS provider. Whatever the box itself is said to be capable of, it must be certified for. The process for doing this varies from country to country. In Germany, for example, the box undergoes a laboratory test then a field test. After this, the Federal Office for Goods Transport (BAG) prepares a report on the certification and the box becomes approved for use on German roads through an approval agreement with BAG. A similar procedure applies in Belgium. As a reputable EETS provider, we are ready and willing to give information about the certification status of our box at any time. Ultimately, it is about the customer’s security of service, and he will very quickly lose confidence in that service if his box does not work.

How do you explain why there is still so much uncertainty on the market?

Now that the idea of EETS has gained the necessary momentum, more and more new players are entering the market. The message has been that as many countries as possible will be covered as quickly as possible in order to direct customer focus onto the product. However, the required certifications are often not available, and the box cannot be used. In my view, this is not at all expedient because I will lose the confidence of the customer if his box does not work or it is not delivered to him on time. Transparent billing must also be provided as well as additional services such as the passage lists shown in DKV eReporting. Emergency processes also play an important role. In other words: What does the customer do if the EETS OBU sometimes fails to work properly? We do not gamble with the trust of our customers. I am convinced that a serious and credible dialogue with our customers and potential customers is the only way to deal with this issue. We do not have to be the first on the market. But we must offer our customers quality products that work as they believe they should.

What is the situation with the DKV BOX EUROPE? What countries will it cover?

We are bang on schedule with the DKV BOX EUROPE. This year will see the tolls for Belgium, Germany, Austria, France, Spain and Portugal made available on the box. Customers will be able to order the box from May onwards. Details of the ordering process and delivery are available to our customers from their local branch office.